A Savings Account

That Moves With You.

No balance rules. No queues. Just better

banking

from the moment you sign up.

Make Every Payment

Worth 10% more.

With Trexo, rewards are built in, not bolted on.

Smart, automatic, and ready when you are.

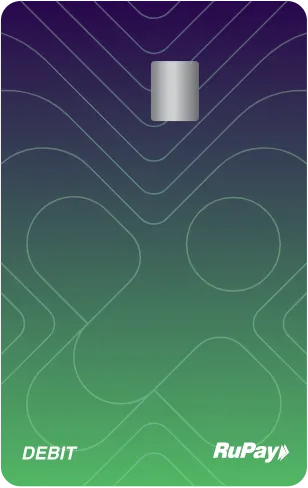

Your Trexo Card, With Perks

That Move You Forward.

Start swiping instantly with your digital card.

Want more?

Get the physical RuPay card for exclusive perks!

FLAT 20% OFF MONTHLY ON SWIGGY & AMAZON

Not Just An Account,

It’s Your Money Assistant.

With Trexo, it’s banking that earns, learns,

and evolves with you.

INSTANT E-DEBIT CARDS

SPENDING INSIGHTS (COMING SOON)

INSTANT KYC & SETUP

Aadhaar/PAN-based video KYC in minutes. No paperwork. No delays.

QUICK ATM WITHDRAWAL

ZERO BALANCE, FULL FEATURES

SPENDING INSIGHTS (COMING SOON)

INSTANT KYC & SETUP

Aadhaar/PAN-based video KYC in minutes. No paperwork. No delays.

QUICK ATM WITHDRAWAL

No Fine Prints. No Surprises.

Here's everything you need to know about what it costs

(and what it doesn’t).

SAVINGS ACCOUNT

₹100

Account Opening Fee

₹0

Minimum Average MonthlyBalance

₹500

Initial Deposit

2.5% per annum

Interest Rate (balance up to ₹1 Lac)

5% per annum

Interest Rate (balance above ₹1 Lac)

Before Video KYC – ₹95,000

After Video KYC – ₹2,00,000

Maximum Daily Balance

₹0

Email Statement

₹100 + GST per request

Physical Statement (adhoc)

15 + GST per month

Monthly Maintenance Fee (covers SMS alerts, SI/ECS)

Rs. 300 + GST

Issuance & Annual Fee

Rs. 250 Annual Premium + GST

Mediclaim (₹30,000 Mediclaim and ₹50,000 Accident Coverage)

FAQ’s.

Understand the how, what, and why of smarter saving with Trexo.

Have More Questions?

Start a conversation with our agents

to get your answers.

- Zero minimum balance

- Free virtual debit card for instant use

- Physical debit card packed with exclusive discounts, complimentary benefits, and insurance coverage

- Seamless integration with trading platforms

- Aadhaar seeding for government benefits

- Trexo reward points for every transaction

- Set personal savings goals.

- Automate transfers to build your savings consistently.

- Round up transactions to grow your savings without thinking about it through Pennywise.

FAQ's.

Understand the how, what, and why of smarter saving with Trexo.

- Zero minimum balance

- Free virtual debit card for instant use

- Physical debit card packed with exclusive discounts, complimentary benefits, and insurance coverage

- Seamless integration with trading platforms

- Aadhaar seeding for government benefits

- Trexo reward points for every transaction

- Set personal savings goals.

- Automate transfers to build your savings consistently.

- Round up transactions to grow your savings without thinking about it through Pennywise.

Have More Questions?

Start a conversation with our agents to get your answers.

Build Momentum For Your Money,

Without Limits.

Open your zero-balance Trexo savings account in minutes.

Start growing your money, your way.

ACCOUNTS

RESOURCES

CAREERS

Become an Agent

Banking & Payment Partners

© Copyright of Trexo.Money

Banking & Payment Partners

© Copyright of Trexo.Money